does unemployment reduce tax refund

Most states do not withhold taxes from unemployment benefits voluntarily but you can request they withhold taxes. Why does my unemployment 1099-g lower my refund by 50.

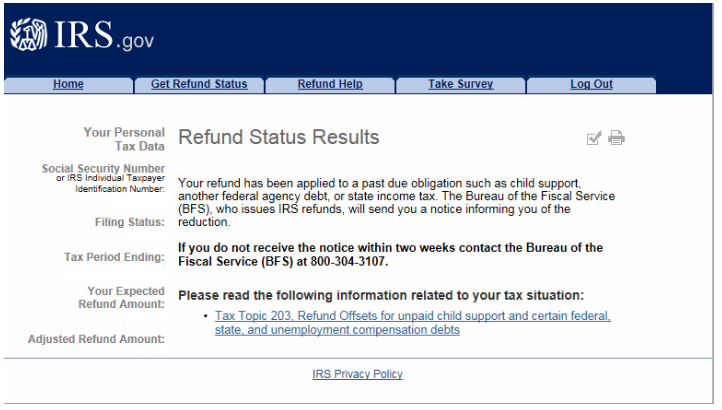

Tax Topic 203 Refund Offset Where S My Refund Tax News Information

So far the IRS has identified 13 million.

. This threshold applies to all filing statuses and it doesnt double to. That would drive the effective FUTA tax rate from 06 percent to 09 percent an increase of 21 in federal taxes per employee. If you are receiving unemployment benefits check with your state about.

A quick update on irs unemployment tax refunds today. But for many jobless workers and their families those payments come with a catch. Select the name of the vendor who submitted the refund check.

To qualify for this exclusion your tax year 2020 adjusted gross income AGI must be less than 150000. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189. Unemployment Insurance UI benefits are taxable income but do not count as earnings.

The Unemployment Insurance Act was recently amended to provide for the personal liability of any officer or employee of an employer who has control supervision or responsibility for the. Federal agency non-tax debts. The american rescue plan act which was signed on march 11 included a 10200 tax exemption for 2020 unemployment.

Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 or 860-297-5962. Illinois residents who received unemployment benefits in 2020 and filed their income taxes before March 15 can expect refunds from the Illinois Department of Revenue as. While it may be.

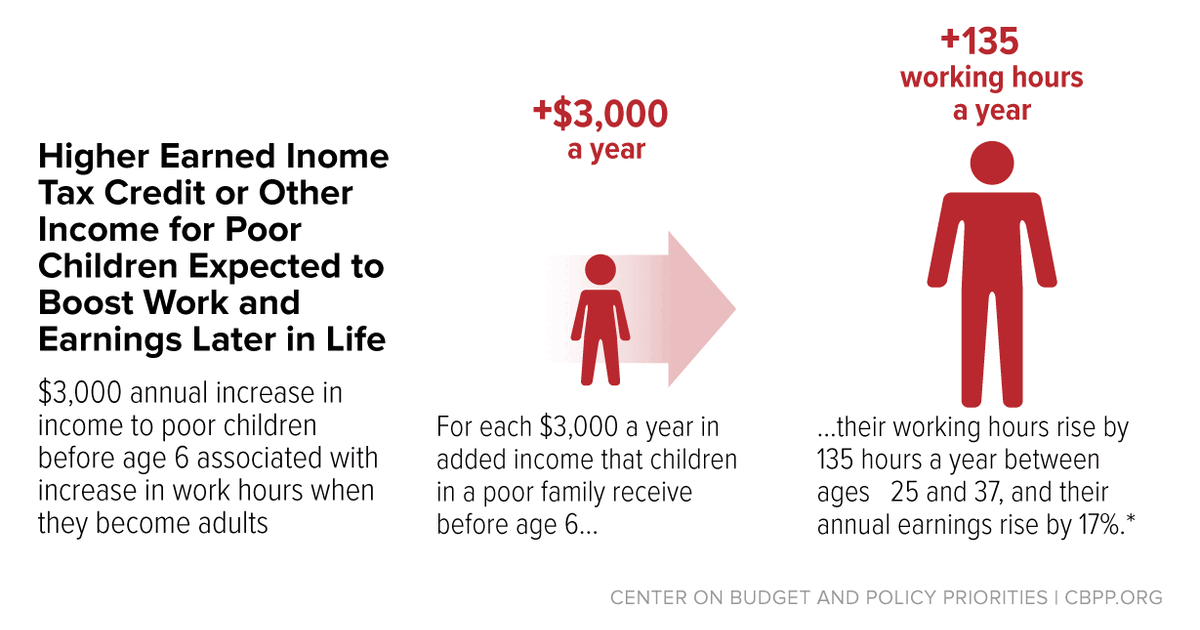

The Earned Income Tax Credit EITC is a refundable tax credit for low-to-moderate income workers who have worked and earned income under the amount of 57414 in 2021. While getting a big tax refund can feel like an exciting windfall the IRS doesnt want you to count on that money too soon. If you received unemployment benefits in 2020 a tax refund may be on its way to you.

Generally unemployment trust fund deficits are. Go to the Employees menu and select Payroll Taxes and Liabilities and click Deposit Refund Liabilities. Dont bank everything on an incoming refund.

Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 or 860-297-5962. They may result in smaller refunds from tax credits such as the earned income tax. IRS efforts to correct unemployment compensation overpayments will help most affected taxpayers avoid filing an amended tax return.

The IRS has sent 87 million unemployment compensation refunds so far. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. Ad File unemployment tax return.

Irs Unemployment Tax Refund Update Direct Deposits Coming

I Understand That Subsidies Come In The Form Of Tax Credits But I M Unemployed And Probably Won T Owe Any Taxes How Would The Subsidy Help Me Healthinsurance Org

Refunds On Taxed Unemployment Benefits Will Come Later Marketplace

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

Eitc And Child Tax Credit Promote Work Reduce Poverty And Support Children S Development Research Finds Center On Budget And Policy Priorities

Tax Season Is Here Don T Expect A Refund For Unemployment Benefits

Tax Adviser March 2022 Page 32

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

What To Know About Irs Unemployment Refunds

State Conformity To Cares Act American Rescue Plan Tax Foundation

How Unemployment Can Affect Your Tax Return Jackson Hewitt

Filing Taxes In 2022 Irs Deadline Tax Credits Unemployment And Tips

The Case For Forgiving Taxes On Pandemic Unemployment Aid

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

Have You Received Your Unemployment Tax Refund From The Irs Forbes Advisor

2020 Unemployment Tax Break H R Block

Unemployment Benefits Are Taxable Income That May Reduce Eitc Refunds Next Spring Tax Policy Center

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Unemployment Tax Break Recipients Could Get As Much As 5k Extra Khou Com